How pay by bank enables smarter, faster payments in the United States

Pay by bank enables consumers to easily pay with their bank by coupling financial account verification with payment processing.

What’s in this post?

Pay by bank is an emerging payment method that allows consumers to send money straight from their bank account to buy goods and services. It works by linking consumer and merchant accounts using a bank aggregator, which securely syncs and shares financial information to initiate and authorize payments.

Instead of entering debit card or credit card details, consumers just log in via their online banking app, verify their identity, and pay by bank.

The result is a modern payment experience that’s straightforward, safe, and enjoyable for consumers.

By avoiding expensive card intermediaries, pay by bank helps businesses save up to 72% on processing fees with a longstanding, transparent connection to their customers.

👀 See the best pay by bank solutions in the U.S.

There are three components to every pay by bank transaction:

For consumers to initiate payment by bank account, they first need to authenticate and link their savings or checking to verify their ability to send funds.

This one-time process takes less than 45 seconds with Aerosync’s bank linking technology, which verifies accounts using a customizable gateway that’s either embedded or sent via payment link.

This generates an instant connection through a single user login using their banking credentials. Open banking APIs eliminate the need for risky screen scraping methods and maintain durable, secure bank links that ensure positive customer experiences.

To stop fraud and reduce risk, pay by bank processors perform real-time fraud and risk detection checks during the authorization process. This confirms only legitimate transactions are processed and reduces returned payments up to 400%.

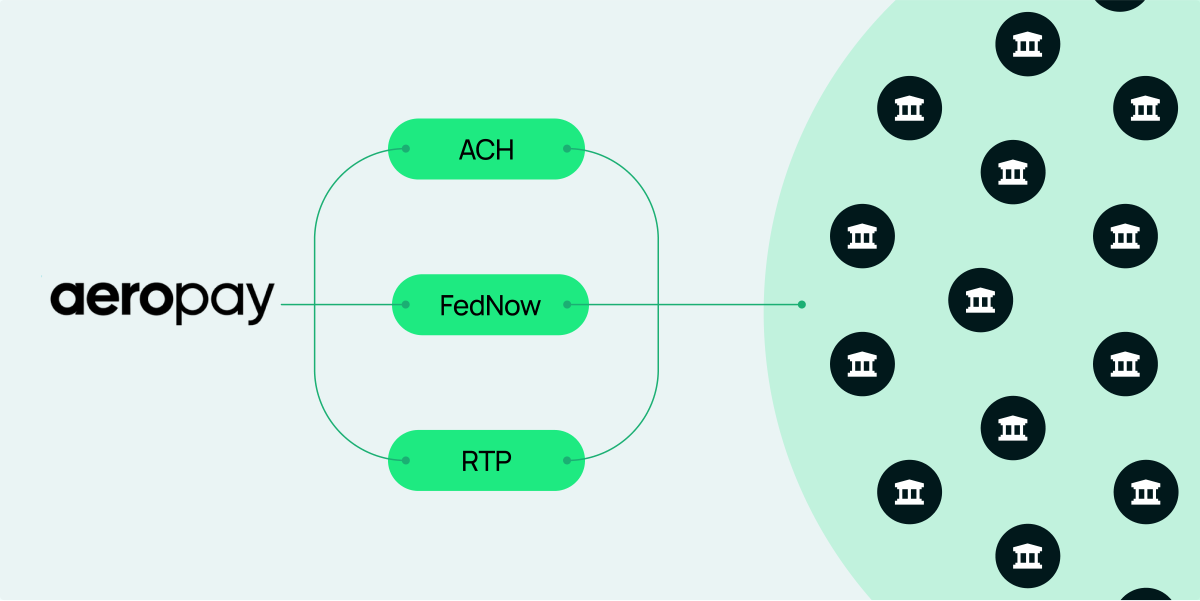

When a pay by bank transaction is approved, the funds flow from customer to business. Depending on the customer bank and the merchant’s payment processing partner, there are three different “rails,” or networks, the money can move along:

1. ACH - The Automated Clearing House offers both ACH credit and ACH debit electronic transactions in a batch environment. Funds are typically processed either that day or in 1 to 3 days, depending on the processing window (First Same Day ACH, Second Same Day ACH, Third Same Day ACH, Next Day ACH). Read more about ACH payments.

2. RTP - RTP® from The Clearing House is a real-time payments platform that offers instant payments on its rails. Almost all U.S. financial institutions have access to RTP, and more are joining as volume grows. Right now, RTP is primarily used to send payments as real-time requests for payment aren’t widely available.

3. FedNow - The Federal Reserve’s instant payment service was launched in 2023 to allow businesses and individuals to send and receive instant payments in real time, around the clock, every day of the year.

Aeropay is a leader in pay by bank for U.S. businesses, establishing direct connections with more than 12,000 financial institutions. We send secure payments along the fastest, most affordable route and instantly default to the next-best option depending on real-time availability.

Pay by bank is quickly gaining momentum because it’s a simple solution to complex payment issues that have existed in the U.S. for decades.

Here are the benefits pay by bank offers businesses:

When consumers pay by bank, merchants pay much lower transaction fees, especially when compared to card processing. This is the biggest pay by bank advantage.

In 2023, U.S. merchants paid $101 billion in Visa and MasterCard credit card processing fees, including $72 billion in interchange fees. Most merchants pay a 2-5% fee for every credit card transaction — and that number’s been increasing.

Because pay by bank uses the low-cost ACH network to move funds, the transaction fee for merchants is up to 72% lower than card processing.

Modern pay by bank solutions focus on simplifying end user onboarding. This means creating a cohesive, branded payment flow that users actually enjoy using.

Additional features like biometric authentication make onboarding so much more convenient that the process can improve customer conversion rates from 65% to 90% — a 25% increase (according to OwnID).

Traditional ACH payments are exposed to higher risk of returns for things like insufficient funds, buyers’ remorse, and bad account info. Pay by bank providers like Aeropay remove this uncertainty with Guaranteed Payments.

Guaranteed ACH Payments ensure, or “guarantee", payments are delivered to merchants without the risk of returns or chargebacks.

Many pay by bank providers that offer guaranteed payments have an average acceptance rate of only 60-70%.

Aeropay’s advanced model leverages AI and machine learning, adapting to the complexities of pay by bank, and dealing with over 50 return codes, predicting user funds at the time of the transaction, and managing dispute patterns.

Get an inside look at pay by bank approval rates.

Open banking ensures transparent data control between financial institutions, merchants, and third-parties. This means businesses have access to real-time data directly from consumers’ banks, improving the authentication process and reducing the risk of fraud.

Merchants are also able to easily verify account information, such as account balance, which ensures funds availability.

At the same time, merchants can set up more effective processes to limit fraudulent transactions, alongside typical processor risk mitigation practices like bank-level authentication and multi-factor authentication (MFA).

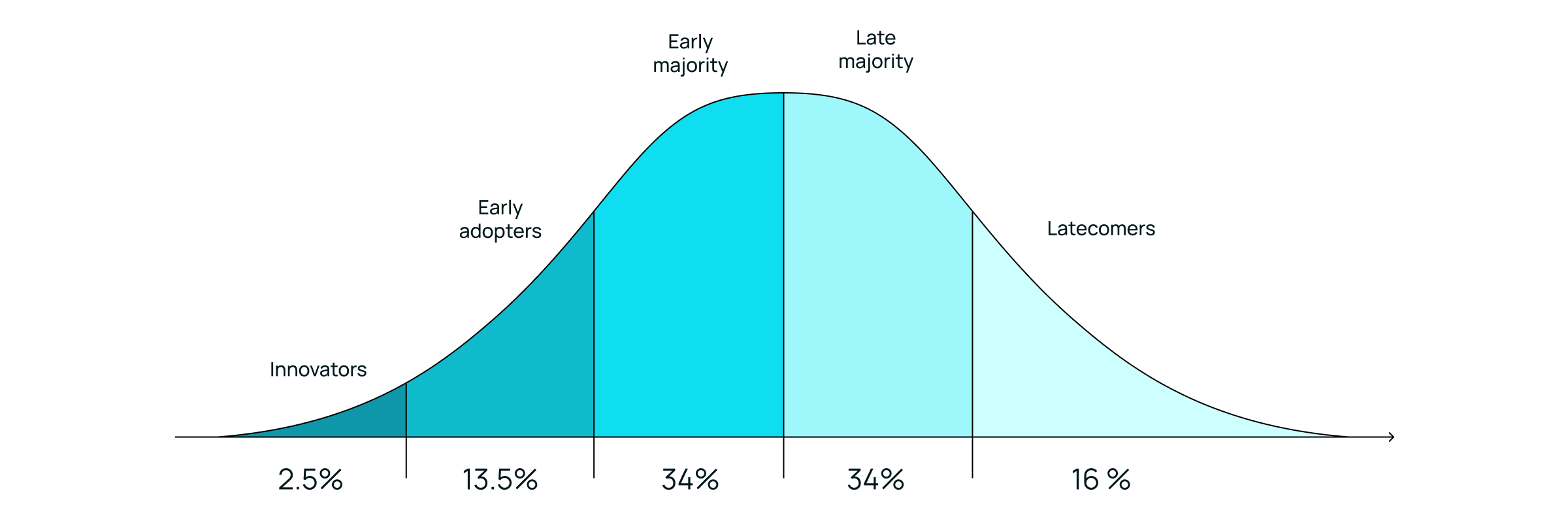

While pay by bank is still on verge of mass U.S. adoption, it’s already being implemented across industries and use cases.

Everyone from contractors to small businesses to enterprise companies are already using pay by bank either in addition to or instead of traditional payment methods.

Here are some popular business types that benefit from pay by bank:

Pay by bank lets you set up recurring ACH payments for memberships or subscriptions.

ACH is more cost-effective than card payments, meaning businesses retain more revenue without worrying about cards expiring or needing constant updates.

Improve ACH adoption and reduce returned payments with a modern bank payment solution that’s as easy as cards, but far more affordable.

Establish longstanding bank connections that allow e-commerce customers to checkout with a single click. The digital payment is sent directly from their account and settles in as little as a few minutes.

ACH payments are the best way to collect rent online. Pay by bank lets your tenants pay by bank account to greatly reduce processing costs and satisfy the fact 8 in 10 renters want online payments without a service fee. Add Guaranteed ACH to ensure funds are accessible on-time, every month.

For businesses in industries like alternative wellness and online gaming, there are more serious compliance requirements that can limit payment acceptance rates.

Pay by bank removes the risk associated with traditional payment methods so these businesses can collect payment safely and successfully, on every transaction.

There are more pay by bank use cases being added as consumers get on board and leading platforms like Aeropay expand into new verticals. Expect to see bank account payments in-store at the point of sale, along with any other instance where cards are traditionally present.

Pay by bank is already a popular choice for use cases like paying bills, but 2025 will be the year it’s relevant everywhere.

Wherever you can pay by card, you can now pay by bank just as easily.

Let’s look at the 4 biggest factors influencing widespread U.S. adoption of pay by bank:

A recent Forbes article found 3 in 4 U.S. workers will be millennials in 2025. As this younger, more digitally native generation takes over the workforce, they’ll look to leverage modern payment solutions to buy cars, pay rent, buy groceries, shop online, and more.

.png)

This is a generation that’s highly motivated by convenience. Six in 10 (61%) of consumers said convenience and ease of use are the most desirable qualities in payments.

Pay by bank also leans on younger generations’ experience with online banking. A PYMNTS Intelligence report found 60% of millennials and 57% of Generation Z primarily use mobile banking apps.

Pay by bank aligns perfectly with the interests of digital natives — expect to see their adoption grow significantly in 2025.

Open banking regulations went into effect in October 2024. This is the catalyst that will finally bring U.S. financial services up to speed with faster and instant payments.

At the same time, total ACH Network payment volume rose 7.4% in the third quarter of 2024 while Same Day ACH volume soared 67.5%.

Plus, real-time payments are gaining a foothold in the U.S. payments space, particularly with instant payouts. The launch of RTP by The Clearing House in 2017 was followed by The Federal Reserve’s launch of FedNow in 2023, which holds ambitious plans to attract up to about 8,000 financial institutions.

The fast growth of these real-time networks has quickly enabled 78% of U.S. bank accounts for real-time credit settlement.

FedNow and RTP are expanding request for payment capabilities — they’ll soon power instant settlement for pay by bank transactions.

Swipe fees cost the average American family over $1,000 annually, either in the form of higher prices or credit card surcharges.

According to a recent poll by NRF, 81% of consumers support federal legislation that would allow for greater competition to lower credit card fees for small businesses.

On the merchant side, decades of litigation against card processors like Mastercard and Visa has been underway to combat excessive interchange fees.

When these major card companies tried to settle, A U.S. judge rejected the proposed $30 billion antitrust settlement. She cited that the fees would remain too high and the card companies would retain excessive control.

Both merchants and consumers are ready for an alternative to credit cards.

Aeropay’s pay by bank platform offers the low cost of ACH, with an advanced interface that’s simple, intuitive, and highly secure.

Now, consumers can easily link their bank account to pay in under 15 seconds, with future transactions completed in a single click.

Aeropay has also identified and resolved the biggest sticking points for merchants accepting bank payments — with advancements like Guaranteed ACH, returned payments are eliminated and funds are accessible instantly.

A modern solution like Aeropay removes friction to onboard new users and encourages them to pay by bank — it’s a safer, more efficient process than paying by card.

Aeropay was founded to move money more effectively and affordably. We started in alternative wellness with a compliance-first approach that doesn’t sacrifice user experience or conversion. That’s been highly effective to build trust for both our merchants and end-users.

The same playbook applies to every new industry we enter — whether it’s online gaming, automated bill payments, property management, or traditional ecommerce/retail. Merchants prefer Aeropay over card networks because it’s much more affordable and risk-averse. Their customers prefer Aeropay because it’s undeniably simple, fast, and straightforward.

The truth is in the data. We’ve already moved $1 billion in funds, prevented $750 million in fraud, and connected over 1 million user banks — all while maintaining approval rates above 90%.

We aren’t going to replace cash or cards, we’re going to empower merchants to lower the high costs associated with traditional payments by adding pay by bank as a primary payment option. Consumers will choose the payment method that best fits their needs. The result will be a more financially inclusive nation.

Yes, paying by bank is incredibly safe. Modern pay-by-bank platforms, like Aeropay, use open banking APIs that eliminate risky practices like screen scraping. Transactions are secured with multi-factor authentication (MFA), bank-level encryption, and real-time fraud detection to ensure your data and funds remain protected.

The key difference lies in how payments are processed:

Pay by card requires a third-party card network (Visa, Mastercard) to process payments, often with high fees for merchants.

Pay by bank directly transfers money from a customer’s bank account to the business, bypassing card networks and reducing costs by up to 72%.

Pay by bank also eliminates risks like card expirations, minimizes fraud, and guarantees payment success, making it a smarter, more affordable option.

Pay by bank offers several advantages to attract credit card users:

With younger, digital-native generations increasingly favoring intuitive payment methods, pay by bank is quickly gaining traction.

Setting up a pay-by-bank service is simple with Aeropay: